Make sure all future premium payments. This process of putting the insurance policy back after a lapse is known as reinstatement.

What To Do When A Health Insurance Policy Lapses Renewbuy

If the coverage resumes later the resumption is known as reinstatement.

. Some of the perks include no-cost virtual care and preventative. An individual can reinstate the policy within the revival period of the life insurance policy provided by the life insurance company in case the policyholder did not make the due premium payment even during the grace period. Fortunately insurance companies provide grace periods for the payment.

It provides information about when the terms of the insurance policy are reset after that claim occurs. Provision is sometimes made for reinstating the policy limit to its original amount when the original limit has been exhausted. However some individual health insurance polices are issued with wording that gives.

If an insured person fails to pay the premium due to various circumstances and as a result the insurance policy gets terminated then the insurance coverage can be renewed. Reinstatement is what happens when you make up missed premium. Also ask what the process to reinstate is and how much longer reinstatement is an option without underwriting.

Click to see full answer. Definition of Reinstatement Definition. If an insured person fails to pay the premium due to various circumstances and as a result the insurance policy gets terminated then the insurance coverage can be renewed.

Reinstatement under many forms of reinsurance and insurance the payment of a claim reduces an aggregate limit by the amount of the claim. There remains a risk in such a situation as you will be without any further coverage at that moment until the cashless Mediclaim period expires. When or if you make a claim under your cashless Mediclaim policy then there is a slight chance that the amount that was insured will be completely exhausted.

Click to see full answer. Insurance coverage can be cancelled in the middle of the policy term for several reasons. A reinstatement clause allows the per occurrence limit to reset and pick up those additional claims under that same occurrence of course limited to the new reinstated limit which otherwise would not be reinsured under that reinsurance contract.

Depending on policy conditions it may be done automatically. This process of putting the insurance policy back after a lapse is known as reinstatement. In some property reinsurance contracts reinstatements are provided for free and can apply as many.

Reinstatement of policy is the process of restoring an insurance policy back in effect after it has been previously terminated due to various reasons. A reinstatement clause is an addition or specific condition listed in a home insurance policy that tells the policyholder when the reinstatement of coverage is possible. However if the premium is not paid within the effective time the policy lapses from what we call the First Unpaid Premium or FUP.

Reinstatement is the act of claiming a position after it has been removed from a person or an entity. Contact your insurance company and inquire about the amount of payment due on a reinstatement. The reinstatement benefit can provide extra coverage and prove to be more useful if you require hospitalization for two different ailments in a year or members of the family covered in the family floater plan require hospitalization during the year.

It applies to situations in which the policyholder has filed a claim. What is life insurance reinstatement. Oscar Health Insurance is a relative newcomer to the health insurance scene.

Reinstatement of Health Insurance Policy. In regards to insurance reinstatement allows a. It attracts charges and the premium is calculated on a pro-rated basis.

An insurance policy can be terminated when the insured has missed the premium payment for several months. In other words the insurance company cannot cancel refuse to renew your policy as long as you continue to pay your premium on time. Most individual health insurance policies are guaranteed renewable for the stated duration eg until age 65 of the policy.

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. Before reinstatement various factors are taken into. Reinstatement of life insurance policy refers to restoration of the previously terminated life insurance policy.

Reinstatement clauses typically do not reset a policys coverage limit but they do allow the policy to restart coverage for future claims. A policyholder has no legal obligation to make premium payments but if he or she fails. In terms of insurance it means that the policyholder gets back the policy after it has become void for lack of payment.

In the first instance the policy is effectively being rewritten while renewal of a policy means that the same policy is being extended for another period of time usually 6 months or 1 year depending on the issuer and type of policy. Reinstatement is what happens when you make up missed premium payments after your plan has been terminated by your insurance company. Reinstatement is when an insurance policy is revived after it lapses.

There is a tremendous difference between a policy being reinstated and having your insurance policy renewed. Reinstatement is the process of re-establishing the status of a person company or law. The SilverFit program is provided by American Specialty Health Fitness Inc a subsidiary of American Specialty Health Incorporated ASH.

This difference is not always adhered to and either type of policy could have the other term applied depending on the policy and. By paying a minimal extra amount in your health insurance premium you can get the benefit of sum. It was founded in 2012 and operates in 18 US.

By way of setting the two terms apart revival is more often used in relation to term life policies that have become inactive and reinstatement is applied to whole life policies that likewise are inactive. If a policys coverage stops in the middle of the policy term we would say that the policys coverage was cancelled. Fill in all paperwork truthfully and remit payment to the correct address to your insurance company.

Some insurers offer this facility more than once while others allow it only once during the tenure of the policy. If an insurance customer doesnt. Before the paying term is over the policyholder should be able to pay for the premium.

Pre Existing Diseases In Health Insurance Meaning Coverage Bajaj Allianz

Tips For Appealing A Denied Health Insurance Claim Nerdwallet

What Is Health Insurance Definition What Is Health Health Insurance Health

Health Insurance Pre Existing Diseases Rules Changed To Benefit Policyholders Mint

What To Do If Health Insurance Policy Renewal Date Is Missed

Health Insurance Policy With Up To Rs 1 Cr Coverage Pay Only For Features You Choose

Restoration Benefit In Health Insurance How Does It Work And How To Make The Most Of It The Financial Express

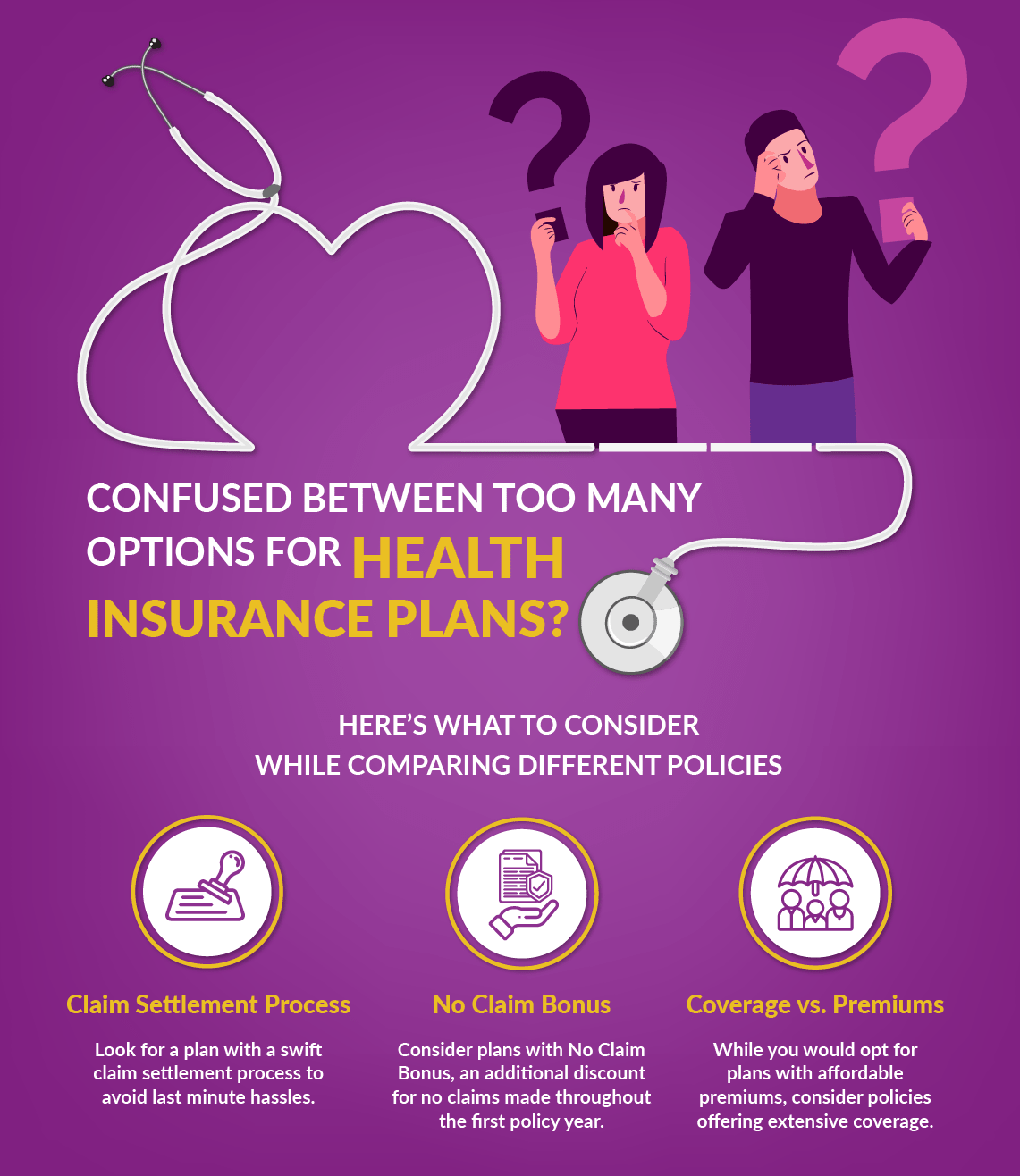

Compare Health Insurance Online Get The Best Policy You Deserve

What Is The Restoration Benefit In Health Insurance And How To Use It The Financial Express

137 Best Insurance Slogans Taglines Life Insurance Facts Commercial Insurance Insurance Marketing

Reassure Unlimited Reinstatement Of Sum Assured Health Insurance Plans Emergency Medical Health Insurance

What Is Restoration Benefit And How Many Times Can You File A Health Insurance Claim In India

Restoration Benefit In Health Insurance Explained Bajaj Allianz

9 Lesser Known Benefits Of Health Insurance

Find Out Everything About The Restore Refill Benefit In Health Insurance

Why Buying Health Insurance Is Important Health Insurance Infographic Buy Health Insurance Life Insurance Marketing

How To Read Your Life Insurance Policy Life Insurance Policy Life Insurance Insurance